Direct consolidation loans Permit you mix many instructional loans into a person. Using this method, you only have 1 every month payment, which makes repayment less complicated.

Cell quantity verification, e-mail deal with verification and cellular application are necessary to accessibility all functions.

Editorial Note: Intuit Credit score Karma gets compensation from third-occasion advertisers, but that doesn’t have an effect on our editors’ viewpoints. Our 3rd-get together advertisers don’t review, approve or endorse our editorial articles. Information regarding financial merchandise not available on Credit Karma is collected independently. Our articles is precise to the most beneficial of our understanding when posted.

Determined by your fiscal circumstance, your personal personal loan application might be authorised promptly. Even so, When your software is much more complex or is lacking info, acceptance could take a bit for a longer period.

Borrowing from the direct lender provides some stability on your personal loan since the mortgage method is handled by the exact same organization from application to funding and beyond, but you should contemplate all of your choices as you could qualify for superior personal loan conditions from a different lender. You may get started off by testing WalletHub’s picks for the best online financial loans.

Critical conclusions shouldn’t be based upon just one number. That’s why your eligibility and personalized personal financial loan or line of credit present will likely be based on taking a look at your broader money picture—not only your credit rating rating.

Direct lenders are financial institutions or fiscal institutions that decide whether or not you qualify for any loan and then challenge the Examine if you do. You may constantly Evaluate unique online direct lenders and choose the one that gives the top circumstances and may perform better in your case. Likely to a direct lender will likely be a more rapidly and less expensive solution, as there's no Center person involved.

Secured by savings — To get a Regions secured personal loan, you’ll need to pledge a Regions financial savings account, CD or cash industry account as collateral. Keep in mind that whilst your account will proceed to accrue fascination, you gained’t have the ability to withdraw the funds through the daily life of the bank loan.

In-man or woman visits to a Bodily lender or lending institution may possibly essentially be needed, therefore you may need to fill out paper programs and provide Bodily copies of supporting paperwork. Accessibility and Advantage

Developments from Examine into Money are intended to bridge a dollars hole amongst paydays. And, even though the reasons you may have the money may be complex, the process to find the loan is straightforward.

Those people cookies include actions including building or using your account within our web-site, crafting critiques, interacting with existing critiques by providing likes or replies, creating other user material on the positioning, putting together custom research or filter Choices, accepting and conserving consumer preferences (which includes privateness Choices), or some other action which affects the way you encounter the website.

1 Non-public direct lenders also supply student financial loans, generally at much better desire charges, but don’t have benefits like consolidation and forgiveness options.

Why Achievable Finance stands out: Possible provides a brief-expression bank loan around $five hundred (in certain states) which you could pay out back again inside two months. Desire is higher — more info averaging nicely into your triple digits for APR — even though this could be decreased than what you might get on the financial loan from the payday lender.

Contrary to a financial loan broker or matching assistance, a direct lender received’t shop your details to varied 3rd functions. This limits your exposure to fraudulent and unscrupulous tactics. Needless to say, it’s often crucial to do your research vetting any organization — together with direct lenders — right before sharing your info with them. While working with a direct lender has selected benefits, it isn’t necessarily a foul notion to employ a financial loan broker. In some cases, personal loan brokers present very good alternatives and they are upfront about how they handle your data. Is NetCredit a direct lender? In particular states, NetCredit gives particular financial loans and lines of credit directly to shoppers. In other states, lending partner financial institutions offer solutions to customers. In All those states, if authorized, your own personal loan or line of credit is going to be produced by certainly one of our lending companions, having said that, NetCredit will support your account and provide all the exact same attributes and Rewards. Test our Fees & Terms web page to view what is offered with your point out.

Patrick Renna Then & Now!

Patrick Renna Then & Now! Anthony Michael Hall Then & Now!

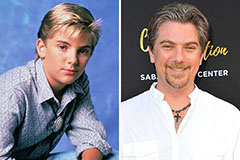

Anthony Michael Hall Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Danielle Fishel Then & Now!

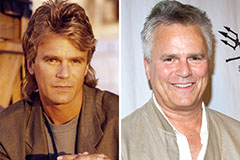

Danielle Fishel Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!